The Memory Shortage Nobody Warned Consumers About Is Finally Here

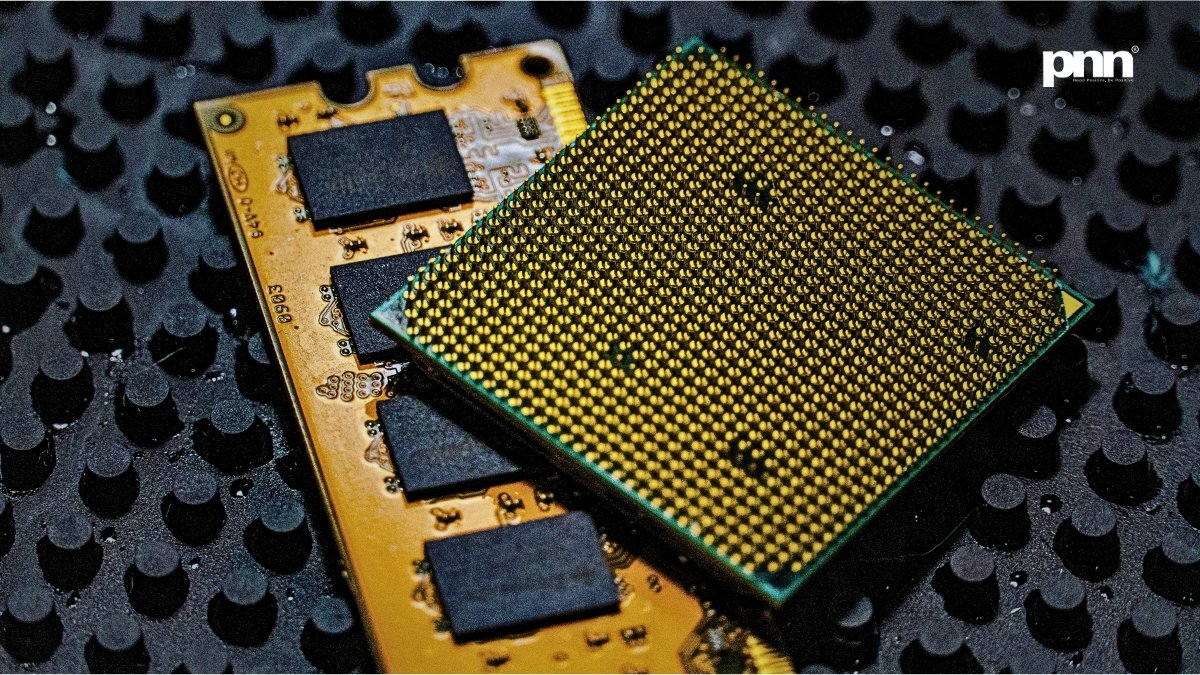

Mumbai (Maharashtra) [India], January 17: There’s a quiet irony unfolding inside the global tech supply chain. Just as consumers are told that artificial intelligence will make life smoother, faster, and cheaper, the physical components powering that intelligence are doing the opposite — tightening supply, inflating prices, and forcing uncomfortable trade-offs. Memory chips, once the most predictable line item in consumer electronics, are suddenly the bottleneck nobody wants to headline.

As 2026 approaches, analysts are no longer whispering about shortages; they’re issuing polite warnings dressed up as forecasts. The reality is less polite. High-bandwidth memory (HBM) is being vacuumed into data centers feeding AI models, cloud inference engines, and enterprise automation. Smartphones and PCs — those quaint everyday devices — are being pushed to the back of the silicon queue.

Progress, it seems, has priorities.

This isn’t a sudden crisis. It’s a slow-motion consequence of years of strategic choices, capital concentration, and a collective industry decision to chase intelligence at scale, even if it means everyday tech gets pricier and less forgiving.

When Artificial Intelligence Eats First, Everyone Else Waits

Memory chips aren’t interchangeable commodities anymore. The surge in demand is overwhelmingly concentrated around advanced memory — HBM, DDR5, LPDDR5X — the kind required to keep AI accelerators fed and responsive. These chips are not only more complex to manufacture, they are also produced in limited volumes by a small number of players.

The result? Allocation over availability.

Manufacturers are diverting capacity toward data centers because that’s where margins are thick, contracts are long-term, and demand is insatiable. A hyperscale buyer ordering memory by the ton will always outrank a smartphone brand negotiating per-unit costs. This isn’t villainy. It’s arithmetic.

The collateral damage lands squarely on consumer devices. Smartphones, tablets, laptops, and even gaming consoles are facing tighter memory supply and rising procurement costs — costs that brands are increasingly unwilling to absorb quietly.

The Consumer Electronics Industry Learns A Familiar Lesson Again

If this feels familiar, it should. The memory market has always been cyclical, oscillating between oversupply and scarcity. What’s different now is the structural shift in who gets priority when supply tightens.

In previous cycles, consumer electronics were the primary demand drivers. Today, they are secondary beneficiaries of a supply chain optimized for AI workloads. The hierarchy has changed.

For consumers, this means:

Flagship smartphones creeping upward in price without adding headline features

Entry-level devices quietly cutting memory configurations

PCs holding launch prices longer than expected

Fewer aggressive discounts, even during seasonal sales

And yes, sales volumes may contract — not because people don’t want new devices, but because price elasticity still exists, no matter how much brands pretend otherwise.

The Slightly Awkward Silver Lining Nobody Wants To Advertise

There is, inconveniently, a positive angle here — though it doesn’t make the checkout experience friendlier.

Higher memory costs are forcing manufacturers to rethink efficiency. Bloated software stacks, gratuitous RAM allocations, and lazy optimization are becoming expensive indulgences. Engineers are being nudged — sometimes dragged — back toward discipline.

This pressure could lead to:

Better memory management at the OS level

Leaner software builds on mid-range devices

Longer support cycles instead of annual churn

Hardware differentiation based on longevity, not just specs

Scarcity has a way of sharpening priorities. Whether brands lean into that or simply pass costs downstream remains to be seen.

The Smartphone Market Faces A Reality Check It’s Been Dodging

Smartphone sales have already plateaued in many regions. Replacement cycles are stretching. Innovation is incremental. Now add rising component costs to that equation, and the industry faces a delicate balancing act.

Raise prices too aggressively, and demand softens further. Hold prices steady, and margins evaporate. The likely compromise? Subtle downgrades: storage tiers reshuffled, memory speeds tweaked, “new” models that feel suspiciously familiar.

Consumers will notice. They always do.

The more uncomfortable truth is that the era of ever-cheaper, ever-more-powerful smartphones may be ending — not because technology stalled, but because it found a more profitable audience elsewhere.

Why This Isn’t Just A Supply Problem — It’s A Strategic One

Memory shortages aren’t purely about manufacturing capacity. They’re about capital allocation. Building new fabs is expensive, time-consuming, and politically entangled. Scaling advanced memory production isn’t as simple as flipping a switch.

At the same time, AI demand isn’t speculative anymore. It’s contractual. Enterprises, governments, and cloud providers are locking in long-term supply agreements. Consumer tech operates on shorter cycles, thinner margins, and more volatile demand.

Guess who loses that negotiation.

This imbalance could persist well beyond 2026 unless memory production expands meaningfully — and even then, pricing may never return to its previous baseline. Once industries adjust to higher price floors, they rarely look back.

The PR Spin Will Be Elegant. The Receipt Will Not.

Expect corporate messaging to lean heavily on phrases like “premium positioning,” “value-driven innovation,” and “strategic pricing alignment.” Translation: things cost more now, and we’re hoping you won’t revolt.

To be fair, not all brands are equally exposed. Companies with tighter vertical integration or long-term supply contracts will weather the storm better. Smaller players, budget brands, and emerging markets may feel the squeeze more acutely.

This could accelerate consolidation — fewer brands, fewer models, higher average prices. Choice narrows quietly while marketing assures you nothing has changed.

What Consumers Can Actually Do (Without Panicking)

This isn’t a call to hoard devices or doom-scroll supply charts. But it is a reminder to adjust expectations.

Practical takeaways:

Buy based on actual need, not annual refresh pressure

Prioritize devices with higher base memory if longevity matters

Be skeptical of “new” models with suspiciously unchanged internals

Expect better deals on older generations — briefly

Scarcity doesn’t eliminate choice; it reshapes it.

A Future Where Intelligence Is Expensive — And So Is Everything Around It

The memory chip shortage isn’t a tech apocalypse. It’s a recalibration. AI didn’t just arrive; it moved in, rearranged the furniture, and claimed the best seat at the table. Consumer devices are still invited — just not first.

Whether this leads to smarter design, fairer pricing strategies, or simply higher bills depends on how honestly the industry responds. History suggests optimism should be cautious.

In the meantime, the next time a phone costs a little more and offers a little less, remember: somewhere, a data center is thinking very hard — and it needed your memory to do it.